Advanced software tools like SAP or Oracle can facilitate this process by providing integrated data management and real-time cost tracking. These tools help ensure that the data used in the analysis is both current and comprehensive, reducing the risk of errors that could skew the results. Additionally, using spreadsheet software like Microsoft Excel can aid in organizing and calculating differential costs, allowing for easy manipulation of data and scenario analysis. Understanding differential costs helps businesses choose the best path. Just like choosing between two products, companies often face various decision-making scenarios.

Are there different types of differential costs?

Short-term and long-term costs can differ significantly, and understanding this temporal dimension is essential for accurate decision-making. For instance, a decision that appears cost-effective in the short term may not be sustainable in the long run. Therefore, businesses must consider the duration over which the costs will be incurred and the potential for changes in cost structures over time. Making the right choice between two products involves a close look at differential costs. You compare what each option will cost you extra over the other. This method helps figure out which product gives you more value for your money.

Characteristics of Differential Costing

The additional requirement may be purchased from the market at Rs. 8.50 per unit. The components of an item are manufactured by another unit under gross profit definition the same management. The concern at present produces per day 600 numbers of each of the two products for which 2,500 labour hours are utilised.

Solved Example of Differential Costing

The marketing director estimates that it will spend approximately $1,000 on television ads every month. The company will also need to hire a millennial at $250 per week to oversee its social media marketing efforts. If the telecom operator adopts the new advertisement techniques, they will spend $2,000 per month in advertising expenses. The differential cost, in this case, is $1,500 ($2,000 – $500).

When the company wants to expand its production capacity, the management may lower the selling price to increase sales. The company reduces the selling price up to a point where the company will still earn a profit and meet the production costs. Businesses use differential cost analysis to make critical decisions on long-term and short-term projects.

- Overheads are variable to the extent of 25 per cent of the present amount.

- Among several alternatives, management opts for the most profitable one.

- Semi-variable expenses blend features of both fixed and variable costs.

- The differential costs of driving acar to work or taking the bus would involve only the variable costsof driving the car versus the variable costs of taking the bus.

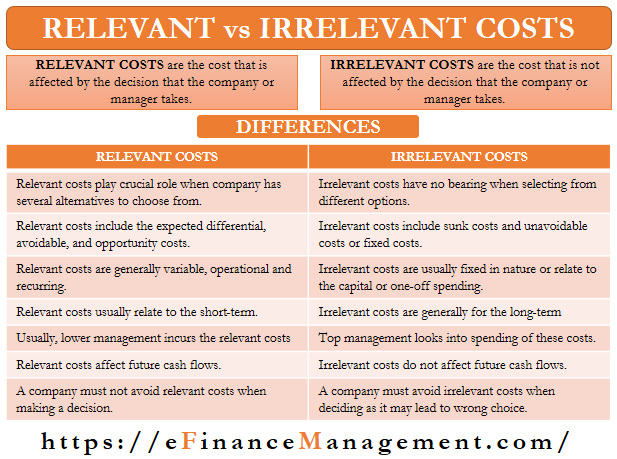

For certain decisions, revenues do not differbetween alternatives. Under those circumstances, management shouldselect the alternative with the least cost. Accordingly, managementshould select the alternative that results in the largest revenue.Many times both future costs and revenues differ betweenalternatives.

This holistic view helps in understanding the long-term financial implications of each decision, rather than focusing solely on immediate cost differences. Differential cost analysis is a crucial tool for businesses aiming to make informed financial decisions. By focusing on the costs that change between different alternatives, this method helps managers identify the most cost-effective options. Thus, differential cost includes fixed and semi-variable expenses. It is the difference between the total cost of the two alternatives. Therefore, its analysis focuses on cash flows, whether it is getting enhanced or not.

To illustrate relevant, differential, and sunkcosts, assume that Joanna Bennett invested $400 in a tiller so shecould till gardens to earn $1,500 during the summer. Not longafterward, Bennett was offered a job at a horse stable feedinghorses and cleaning stalls for $1,200 for the summer. The coststhat she would incur in tilling are $100 for transportation and$150 for supplies. The costs she would incur at the horse stableare $100 for transportation and $50 for supplies.

Moreover, differential cost analysis can inform dynamic pricing strategies, where prices are adjusted based on real-time market conditions. For example, an airline might use differential cost analysis to set ticket prices based on factors such as fuel costs, demand patterns, and competitor pricing. By continuously monitoring and adjusting prices, the airline can maximize revenue while ensuring that its pricing remains competitive. This approach requires sophisticated data analysis tools and real-time cost tracking, but the potential benefits in terms of increased profitability and market responsiveness are substantial. The differential revenue is obtained by deducting the sales at one activity level from the sales of the previous level. The differential cost is compared to the differential revenue to determine the most profitable level of production and the best selling price.

The first proposal results into a loss and hence is not acceptable. (i) To process the entire quantity of ‘utility’ so as to convert it into 600 numbers of ‘Ace’. Discontinuing a product to avoid the losses and increase profits – decision to drop a product line. Among several alternatives, management opts for the most profitable one.