There’s no specific payroll tax in Illinois, but employers are obligated to contribute to the state’s unemployment insurance fund. On top of that state sales tax, local governments can impose their own sales taxes, which can add to the costs of purchases made in different jurisdictions. Illinois also has a set of tax agreements with the neighboring states of Iowa, Kentucky, Michigan and Wisconsin through which those states don’t tax Illinois residents who work within their borders.

How Income Taxes Are Calculated

You are required to electronically file Form IL-941, Illinois Withholding Income Tax Return, quarterly. See Publication 131, Withholding Income Tax Payment and Filing Requirements for more information. You must, however, keep this information in illinois state income tax rate 2022 your records and provide it upon request.

Overview of Illinois Taxes

In the absence of allowances, filers are required to enter annual dollar amounts for things like income tax credits, non-wage income, itemized and other deductions and total annual taxable wages. In 2022, the tax rate for nearly every low- and middle-income earner was reduced as legislators voted to collapse the two lower tax tables into one. 380, reducing the state’s top marginal individual income tax rate from 6.925 to 6.5 percent while consolidating seven individual income tax brackets into five.

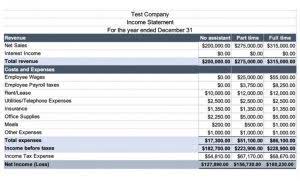

Illinois: Federal FICA Rates in 2022

- These reduce a taxpayer’s total tax bill by some amount, which is in contrast to tax deductions, which only reduce a taxpayer’s taxable income.

- For all taxpayers with AGI of $20,000 or less and claiming a dependent, the dependent exemption is $1,000.

- We believe everyone should be able to make financial decisions with confidence.

- Qualified education expenses over $250 are eligible for a tax credit.

- However, implementation of that law has been suspended pending the outcome of Prop.

- Illinois also has a set of tax agreements with the neighboring states of Iowa, Kentucky, Michigan and Wisconsin through which those states don’t tax Illinois residents who work within their borders.

Illinois has a flat income tax of 4.95%, which means everyone’s income in Illinois is taxed at the same rate by the state. No Illinois cities charge a local income tax on top of the state income tax, though. Qualified education expenses over $250 are eligible for a tax credit. Parents or legal guardians of full-time students under the age of 21 at the end of the school year can claim the credit as long as the student attended kindergarten through 12th grade at a public or nonpublic school in Illinois during the tax year. Start one or more free state income tax calculators and get an estimate of your state taxes. This free tax calculator will provide you with your esimtated tax return results.

While the 2024 tax filing season is shortly upon us, practitioners should be mindful of these updated and changed rates and thresholds to help navigate their clients in tax planning for the current year. “For too long, millionaires have been getting tax breaks, and Illinois homeowners have been getting higher and higher property tax bills,” Quinn said ahead of Tuesday’s vote. (hh) Ohio’s personal and dependent exemptions are $2,400 for an AGI of $40,000 or less, $2,150 if AGI is more than $40,000 but less than or equal to $80,000, and $1,900 if AGI is greater than $80,000. (gg) New Hampshire does not tax earned income, but has a tax (currently phasing out) on interest and dividend income. The tax rate for Illinois will be updated as soon as they are available.

For taxpayers with more than $100,000 in AGI, assets = liabilities + equity the dependent exemption is $300 per dependent. If you file your taxes as single, any earnings you make in excess of $200,000 will be subject to an additional 0.9% Medicare tax, which is not matched by your employer. Joint filers making over $250,000, and married individuals with more than $125,000 filing separately, also pay the Medicare surtax.

Illinois Sales Tax

- The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding $200,000 (head of household) or $400,000 (married filing jointly).

- The portion of compensation subject to Illinois withholding equals the total compensation paid to the employee multiplied by a fraction equal to the number of working days the employee spent within Illinois during the year divided by the total working days of the year.

- In 2024, Illinois imposes a flat state income tax rate of 4.95% for all taxpayers regardless of income level.

- Certain tax deductions may reduce the taxable estate below the taxable limit, and property or assets left to the husband, wife or civil union partner or the decedent are not taxable.

- Then compensation is considered paid in Illinois and is subject to Illinois income tax withholding.

- You can claim 5% of the real estate tax you paid on your principal residence on your Illinois tax return.

For single taxpayers, the deduction must be between $2,140 and $4,830. For joint taxpayers, the deduction must be between $4,280 and $9,660. Federal deductions and exemptions are indexed for inflation, and where applicable, the tax year 2022 inflation-adjusted amounts are shown.